Medicare Supplement Plan

What Is a Medicare Supplement Plan?

Medicare offers beneficiaries a wide variety of benefits, but it doesn’t pay for everything. If you manage a chronic condition (or more than one) or visit multiple doctors regularly, those costs add up quickly. That’s where Medicare Supplement Insurance comes in.

Commonly known as Medigap, this is a private insurance policy that helps cover some of the costs that Medicare doesn’t. Typically, this means co-payments, co-insurance, and deductibles. With a Medigap policy, Medicare pays its share of Medicare-approved healthcare costs and then your supplemental insurance pays its share. If any amount remains, you are responsible for those costs.

Click on the Plan Letters to the Left to see a chart and a description of what each plan covers.

About Medicare Supplement Plan A

About Medicare Supplement Plan A

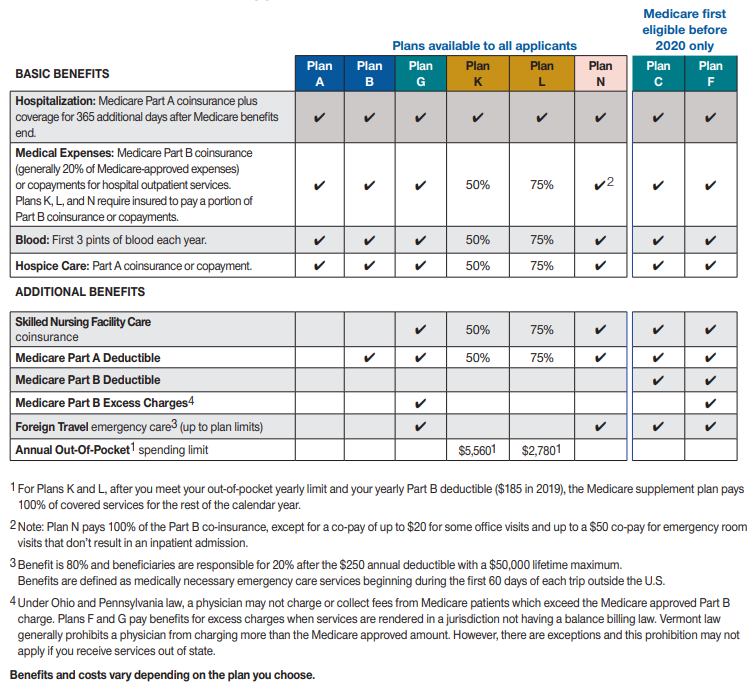

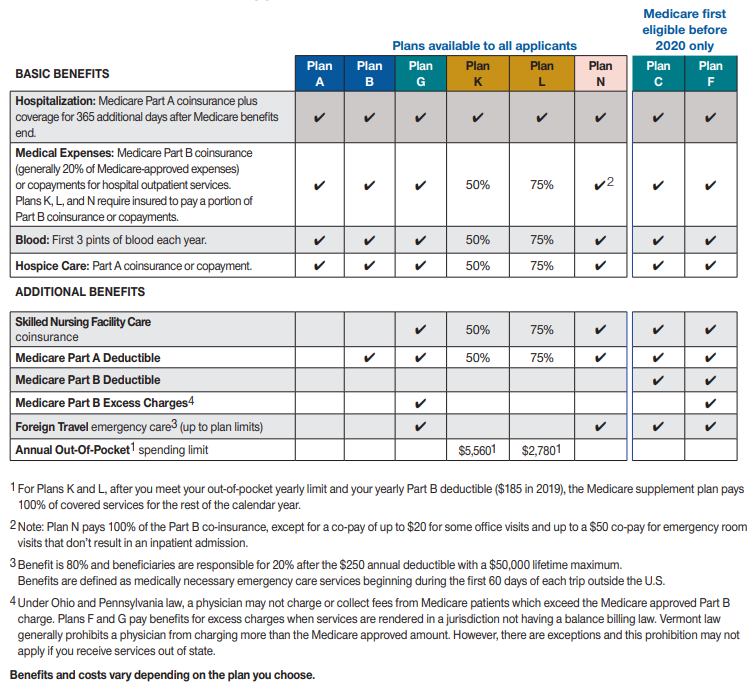

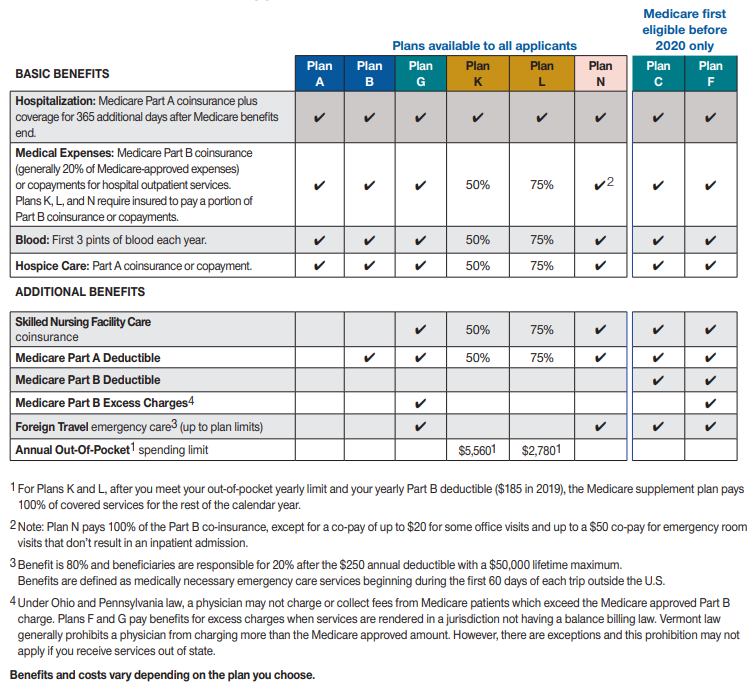

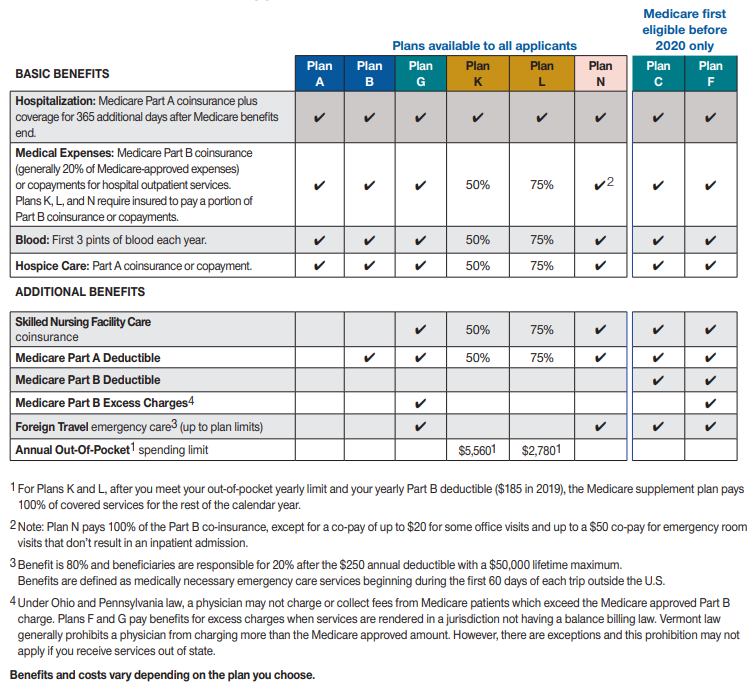

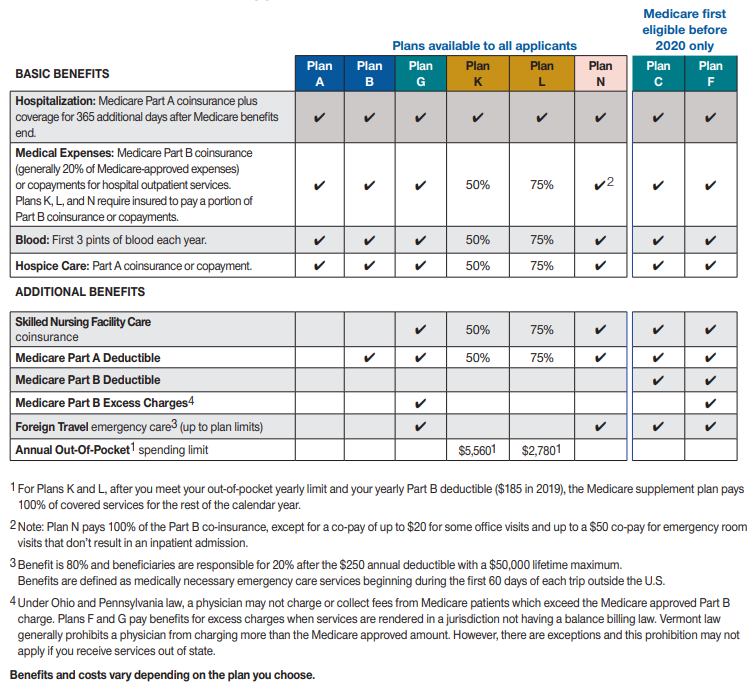

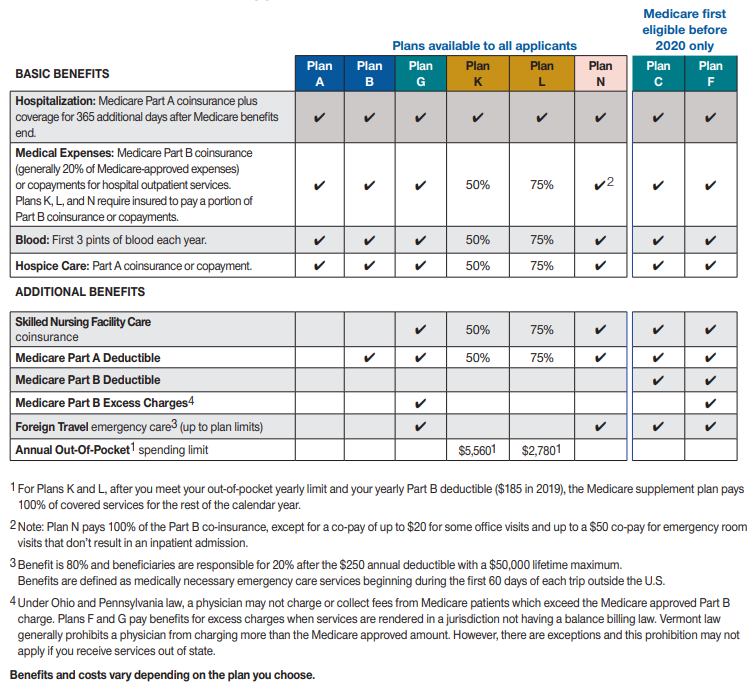

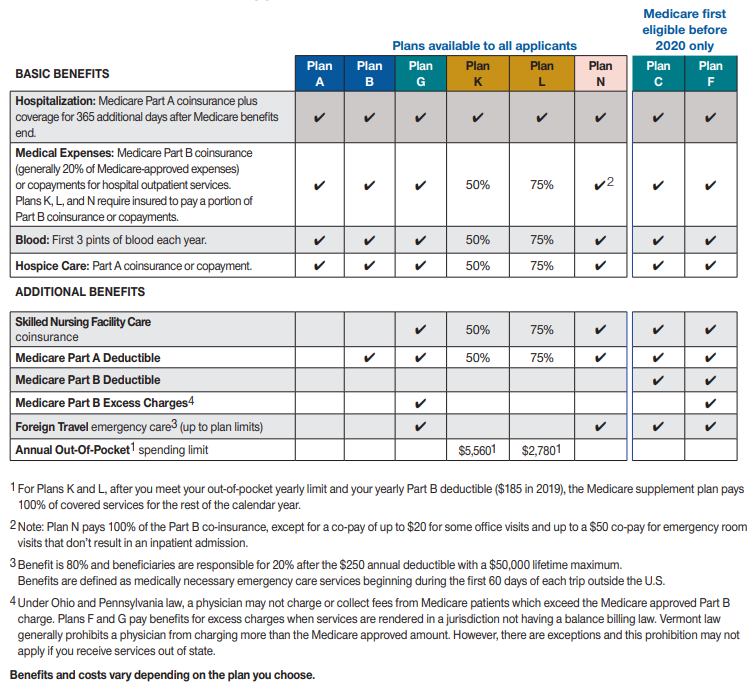

Medigap policies are standardized, meaning each plan letter offers the same benefits no matter which insurance provider you choose. Insurance companies that sell Medigap policies must offer Medigap Plan A. Price and service can vary by insurance company, however, so it is important to research and compare to find the plan that best fits your needs.

Medigap Plan A offers basic service coverage to the policyholder. An advantage to Plan A is that you might not have to pay for benefits you don’t think you’ll use. On the other hand, this could also result in extra costs, should you need more services. If you feel you need only basic coverage and can assume the remaining risk yourself, Plan A might be a good choice for you.

Some of the benefits Medigap plan A offers are hospitalization, medical expenses, and blood (first 3 pints). Hospitalization covers the coinsurance for Part A as well as compensation for the next additional year (365 days) after your Medicare benefits are used up. Plan A will also pay the coinsurance or co-payment for Medicare Part B as well as Medicare Part A hospice care coinsurance or co-payment.

Plan A does not cover several of the benefits that some of the more comprehensive plans cover. Some of the benefits that aren’t covered are the coinsurance for skilled nursing facility care, the deductibles for both Medicare Part A and B, and benefits for travel outside of the United States. Medigap Plan A does not cover any excess charges under Part B. Plan A coverage is limited to Medicare-approved charges. This means that you may be responsible for paying additional compensation yourself if your doctor charges more than the Medicare-approved amount. Plan A also does not cover at home recovery or preventive care.

It can be difficult to determine which plan is right for you, and not all insurance carriers offer all of the Medicare supplement plans. Most insurance carriers offer a variety of plans, and our licensed sales agents can help you find the plan that would best meet your needs

What Is Medigap Plan B?

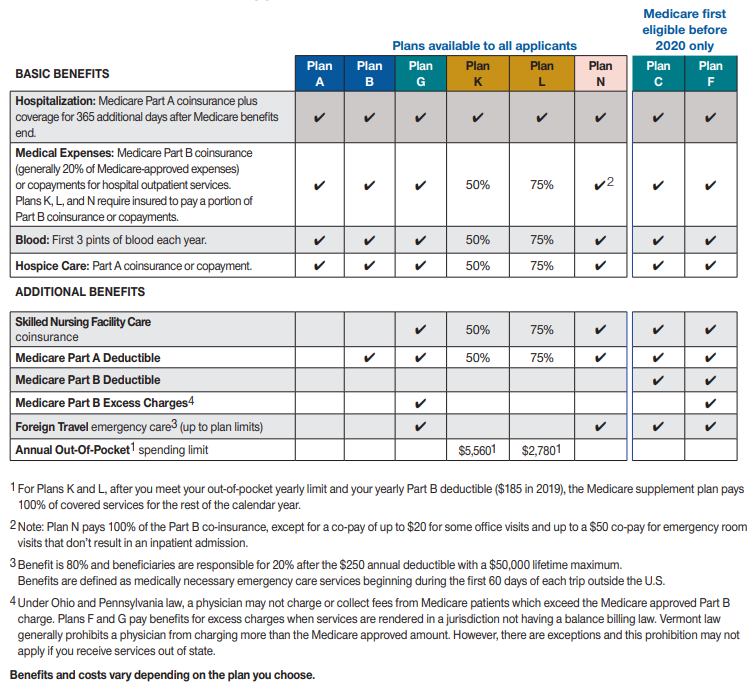

Standardized Medicare Supplement Plan B covers the same basic benefits as Plan A and also covers the Medicare Part A deductible. It is available in most states. This plan may leave many of the risks for medical costs to you because Plan B does not cover skilled nursing facility benefits, Medicare Part B deductible, Medicare Part B excess charge (the amount a health care provider charges above the Medicare-approved amount), or foreign travel benefits.

Plan B includes coverage for the basic benefits, which include hospitalization, medical expenses, and blood coverage for the first three pints of blood each year. Hospitalization includes Medicare Part A coinsurance plus coverage for 365 additional days after Medicare benefits end. Plan B also includes the Medicare Part A hospice care coinsurance or co-payment.

Plan B does not cover several of the benefits that more comprehensive plans cover. Some of the benefits that aren’t covered are the Medicare Part B deductible, skilled nursing facility coinsurance, and foreign travel emergency care. Plan B coverage is limited to Medicare-approved charges. This means that you may be responsible for paying any additional out-of-pocket expenses.

Plan B also does not cover at home recovery or preventive care, however, if you have Medicare Part B, this already covers preventive services, as well as mental health outpatient care and limited outpatient prescription drugs, among other medically necessary services.

It can be difficult to determine which plan is right for you, and not all insurance carriers offer all of the Medicare supplement plans. Most insurance carriers offer a variety of plans, and our licensed sales agents can help you shop around for the plan that would best meet your needs and budget.

What Is Medigap Plan C?

Medicare supplement Plan C offers coverage for your primary medical expenses above the basic benefits. This plan offers the basic coverage of Plan A and more, however, it does not cover Medicare Part B excess charges as do the more comprehensive Plans F and G.

Plan C provides coverage for the basic benefits, which include hospitalization, medical expenses, and blood coverage for the initial three pints annually. Hospitalization includes coverage for your Medicare Part A coinsurance up to an additional 365 days after Medicare benefits are used up. Medical expenses include paying coinsurance for Medicare Part B, or co-payments for hospital outpatient services.

Plan C also includes Skilled Nursing Facility care, the Part A and B deductibles, and emergency services during travel abroad. Part A hospice care coinsurance or co-payment is also included in Plan C.

Even though Plan C coverage does not include excess charges from Medicare Part B, it does pay all of the approved costs of your services. Under Plan C, coverage is limited to Medicare-approved charges. This means that you may be responsible for paying additional out-of-pocket expenses if your doctor charges more than the Medicare approved amount.

It can be difficult to determine which plan is right for you, and not all insurance carriers offer all of the Medicare Supplement Plans. Most insurance carriers offer a variety of plans, and our licensed sales agents can help you shop around for the plan that best fits your needs.

What Is Medigap Plan D?

Medicare supplement Plan D is designed to cover many of the high-risk gaps that are not covered by Medicare Parts A and B. This plan also offers lower premiums than the more comprehensive plans like Plan F. Medicare Supplement Plan D is one of the few Medicare supplement Plans that offers enrollees preventive care coverage.

Medigap Plan D coverage includes the basic benefits that include hospital coinsurance, the Medicare coinsurance for Part B, 365 additional days of hospitalization coverage, and blood coverage for the first three pints. Medigap Plan D also includes skilled nursing coinsurance, the deductible for Part A, and hospice care coinsurance.

Medigap Plan D does not include coverage for the Part B deductible, or any excess costs for Part B. Excess costs are the difference between what the doctor charges you and the Medicare-approved amount.

It can be difficult to determine which plan is right for you, and not all insurance carriers offer all of the Medicare Supplement Plans. Most insurance carriers offer a variety of plans, and our licensed sales agents can help you shop around for the plan that best fits your needs and budget.

Plan F’s Popularity

Medicare supplement Plan F is a more comprehensive plan than the others as far as benefits for the enrollee. Each insurance carrier decides which Medigap policies it wants to sell, although state laws might affect which ones they offer. If an insurance carrier offers any Medigap Plan they must also offer Plan F as well as Plan C.

What Does Plan F Offer?

Plan F covers the Medicare Part A co-insurance and deductible, Medicare Part B co-insurance or co-payment and deductible, and 100 percent of the Part B excess charges.

Benefits

Plan F covers benefits like coinsurance for hospice services, skilled nursing facility treatment coinsurance, and foreign travel emergency insurance.

Plan F insurance

Plan F covers Medicare Part B excess charges, which result from the difference between what a physician charges for services and what Medicare will compensate the physician for those services. The doctor can charge you up to 15% of the amount not covered by Medicare, but Plan F will cover this difference. You can also enroll in a Plan F policy with a high deductible. If you choose this option, it means you must pay for Medicare-covered costs up to the deductible amount of $2,340 in 2020 before your Medigap plan pays anything. Plan F may shelter you from higher payments that you must pay yourself if you need health services that are more expensive than what Medicare will pay.

What doesn’t Plan F cover?

Plan F does not cover preventive care or at home recovery care. You can call our licensed sales agents for more information and help finding the right plan for your needs.

What Is Medigap Plan G?

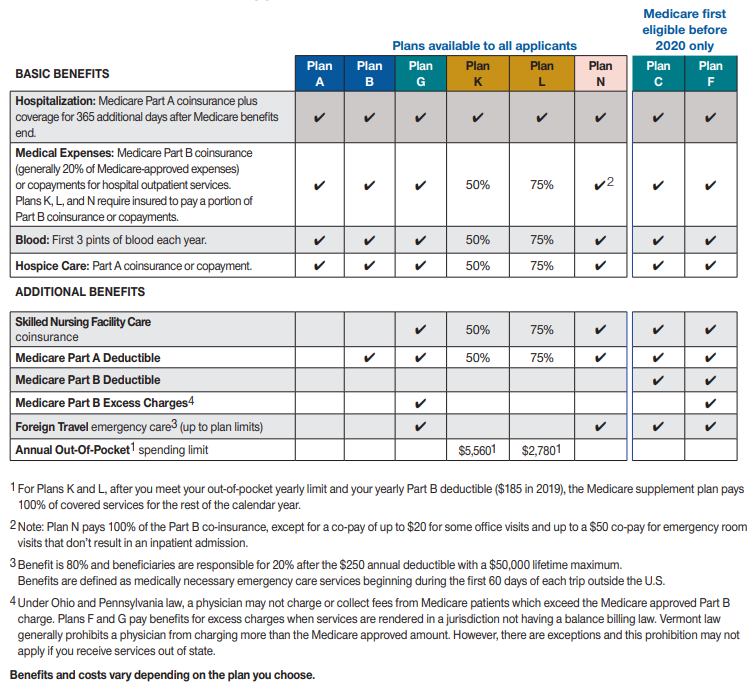

Medigap Plan G has many benefits, including Part A coinsurance and hospital costs up to an additional 365 days after Medicare benefits are used up, Part B coinsurance or co-payment, first three pints of blood, Part A hospice care coinsurance or co-payment, 80% of foreign travel emergency exchange, and skilled nursing facility care benefits. However, it does not include the Medicare Part B deductible. This should be taken into consideration before choosing a plan.

If you do not mind assuming the risk for the Part B deductible, then this could be the right plan for you.

Plan G also includes coverage for home-based recovery care and covers 100% of Medicare Part B excess charges.

It can be difficult to determine which plan is right for you, and not all insurance carriers offer all of the Medicare Supplement Plans. Most insurance carriers offer a variety of plans, and our licensed sales agents can help you shop around for the plan that will best fit your needs and budget.

What Is Medigap Plan K?

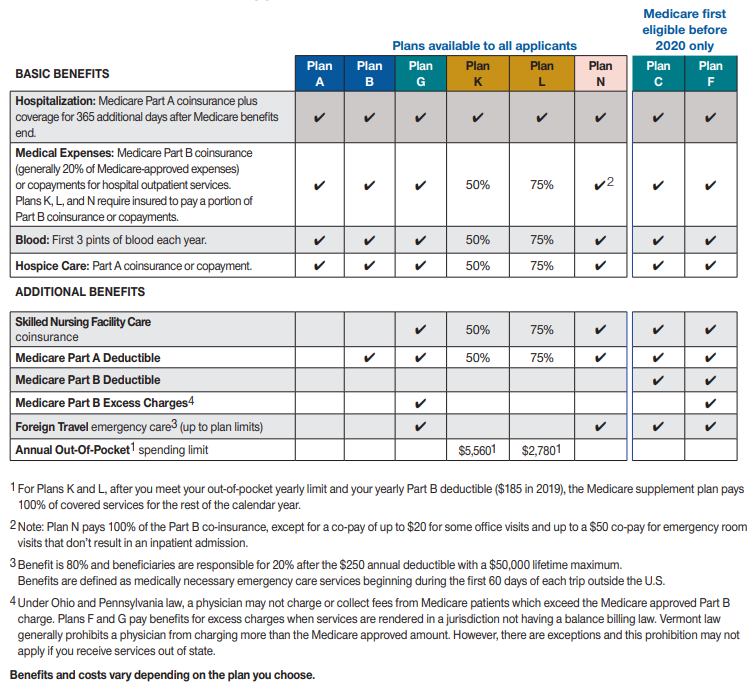

Plan K utilizes different cost-sharing for items and services than most of the supplement plans. Instead of paying all of your costs, the plan will pay a certain percentage until you meet the yearly cap for out-of-pocket spending. Once you meet the limit, the Medigap policy plan pays 100% of Medicare-approved costs, such as the Medicare Part B co- coinsurance, and the Medicare Part A deductible for the rest of the calendar year.

Specifically included with Plan K benefits are Part A coinsurance and the 365 hospital days after your Medicare benefits are used up. Plan K covers 50 percent of your out-of-pocket costs for Part B co-insurance, hospice care, the Part A deductible, and skilled nursing facility services. Blood coverage is also covered at 50% after the first 3 pints.

Your Medicare Part B deductible is not covered. Also, charges from your doctor that exceed Medicare-approved amounts, called “Part B excess charges,” aren’t covered and don’t count toward the out-of-pocket limit. Also not included in this plan is emergency travel abroad coverage, so be aware of this when traveling. Benefits for home healthcare recovery are also not included in Plan K.

The maximum amount that you are responsible for paying yourself (out-of-pocket limit) for 2020 is $5,880 and can increase each year due to inflation.

Plan K could be a good option if you prefer a lower premium and also have low medical expenses but still want a fair amount of coverage for a wide variety of services.

Not all insurance carriers offer all of the Medicare Supplement Plans. It can also be difficult to determine which plan is right for you. Our licensed sales agents can help you find the plan that best fits your needs and budget. Most insurance carriers offer a variety of plans, so our licensed sales agents can help you shop around for the plan that best meets your needs.

What’s Medigap Plan L?

Medicare Supplement Plan L may be a good choice for those with low medical expenses, as it has an out-of-pocket limit. This gives enrollees the potential of a low monthly premium.

Plan L utilizes different divisions of cost for items and services than most of the supplement plans. You will have to pay some expenses yourself for some covered services until you meet the yearly cap. After you hit the yearly limit, your Plan L policy pays these expenses until the end of the year.

Benefits specifically included with Plan L include Part A co-insurance and expenses for 365 days after your hospital benefits end. It also covers Medicare Part B co-insurance at 75 percent for all services except preventive care. Also covered at 75 percent are skilled nursing facility services, hospice care co-insurance or co-payment, and the Medicare Part A deductible. Blood coverage is also covered at 75 percent after the first three pints.

There are services and benefits not covered under Plan L. The Part B deductible is not covered and any excess charges are also your responsibility. Emergency coverage for travel abroad is not included with this plan, so be aware of this when traveling. Recovery at home benefits are also not included in Plan L. The out-of-pocket limit, (amount that you are responsible for), in 2020 is $2,940 and may increase or vary from year to year.

Not all insurance carriers offer all Medigap Supplement Plans and it can be difficult to determine which plan is right for you. Most insurance carriers offer a variety of plans, so our licensed sales agents can help you shop around for the plan that will best fit your needs.

Plan M

Medigap Plan M offers many cost-sharing benefit options and includes many similar benefits to Plan D, but will only cover 50% of the Part A deductible.

Plan M covers Part A hospital co-insurance, skilled nursing facility benefits, and hospice co-insurance. However, it does not cover the Part B deductible ($198 in 2020) and only covers half of the Part A deductible ($1,408 in 2020). However, once you meet your Part B deductible, you will not be responsible for co-insurance for appointments with your physician.

Medigap Plan M also includes coverage for hospital costs up to an additional 365 days after Medicare benefits are used up, coinsurance for Part B, blood services (first three pints), hospice coinsurance for prescription drugs, and 80% of foreign travel emergency benefits.

Not all insurance carriers offer all of the Medicare Supplement Plans. It can also be difficult to determine which plan is right for you. Most insurance carriers offer a variety of plans, so our licensed sales agents can help you shop around for the plan that would best fit your needs.

What Is Medigap Plan N?

Medigap Plan N is similar to Plan D, with differences in how it covers Part B expenses. Specifically, Plan N pays 100 percent of your Part B co-insurance, but you have a $20 co-pay for some office visits. In addition, you have a co-pay of up to $50 for emergency room visits that do not result in an inpatient admission.

Medicare supplement Plan N has 100% coverage for the Medicare Part A deductible but no coverage for the Medicare Part B deductible. Medicare supplement Plan N does cover the basic core benefits, which include complete coverage for Part A inpatient hospital coinsurance, the total expense for inpatient hospital care for 365 days after Medicare benefits run out, blood services (initial three pints), coinsurance expenses for Medicare Part B, Part A hospice coinsurance, and the emergency benefits for travelling abroad, up to 80%. All of the Medicare supplement Plans include some level of hospice care.

Plan N may be a good option if your goal is lowering out-of-pocket responsibilities. Not all insurance carriers offer all of the Medicare Supplement Plans. It can also be difficult to determine which plan is the right fit for you. Most insurance carriers offer a variety of plans, so our licensed sales agents can help you shop around for the plan that best fits your needs.